A closer look at the Smart S&P/NZX 50 ETF

The Smart S&P/NZX 50 ETF offers a simple, cost-effective way to invest in New Zealand shares.

Overview

The Smart S&P/NZX 50 ETF offers investors an easy way of gaining exposure to New Zealand shares. Tracking the S&P/NZX 50 Gross with Imputation Index, this fund holds 50 of New Zealand’s largest listed companies.

Key features

Portfolio of 50 leading NZ companies with the purchase of one security

Exposure to approximately 90% of the total market capitalisation (value) of the New Zealand market1

Dividend yield of 2.59%2

Annual fund charge 0.20%

Convenience of a listed Portfolio Investment Entity (PIE).

Benchmark

The fund’s benchmark is the S&P/NZX 50 Gross with Imputation Index. This index is designed to measure the performance of the 50 largest, eligible stocks listed on the Main Board of the NZX. The 50 companies with the largest market value are included in the index. Known as ‘market capitalisation’, this market value is calculated by multiplying a company’s shares on issue by its share price. This market value is ‘float-adjusted’3 to only include shares which are available for public trading.

‘Gross with imputation’ means that the index includes not just the share price movements and dividends, but also the value of imputation credits attached to dividends. This index is widely considered New Zealand’s preeminent benchmark index. It covers approximately 90% of New Zealand’s equity market total capitalisation.1

The index is rebalanced quarterly, but the companies included in the index do not change often. From June 2022 to June 2025 there have been only five stocks removed and five added. That’s an average of just over 3 a year, or just 6.7% pa of the fund’s holdings.4 This level of stability in the membership of the index is positive for the fund as it helps minimise fund turnover (trading activity) and it therefore keeps costs lower for investors.

Listed Portfolio Investment Entity

The Smart S&P/NZX 50 ETF is a listed Portfolio Investment Entity (PIE) and is taxed at a rate of 28%. The PIE tax rules can simplify tax compliance for investors by allowing PIE-compliant funds to manage tax obligations at the fund level. Distributions received from a Smart ETF will not generally need to be included in your income tax return.

However, if you are a New Zealand tax resident currently paying tax at a rate less than 28%, you may benefit from including the fully imputed portion of distributions from a Smart ETF, including any bonus issues, in your tax return. Doing so could allow you to use the excess tax paid by the Smart ETF to reduce the tax payable on other income you’ve earned throughout the year.

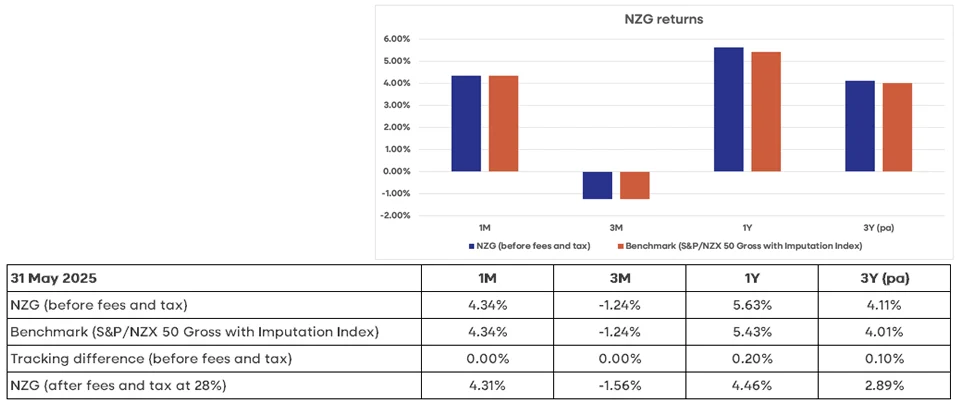

Performance

The Smart S&P/NZX 50 ETF’s investment objective is to track the return (before tax, fees and other expenses) of the S&P/NZX 50 Gross with Imputation Index. The performance of the fund and its benchmark is shown below. Over three years its tracking difference versus its benchmark is +0.10% per annum.

Past performance is not a reliable indicator of future performance. Investment returns can fluctuate and may be negative, even over the minimum suggested investment timeframe of 5 to 10 years and longer.

Source: Smart. These returns are calculated using Net Asset Value (NAV), not market price.

Role of New Zealand shares in a portfolio

How much of a share portfolio should be invested in New Zealand shares?

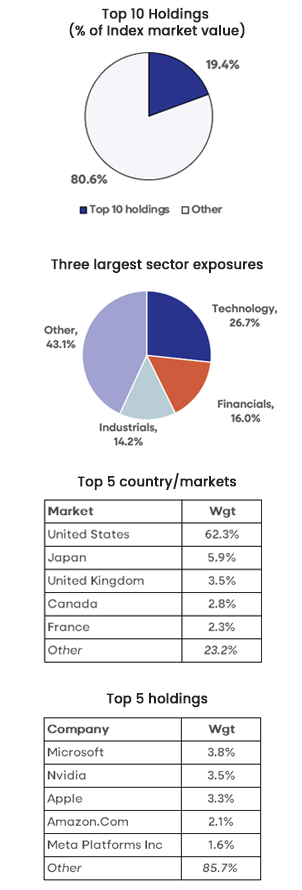

The investment term ‘home bias’ refers to the fact that investors tend to invest more into their home market than in global markets. The New Zealand market is small in a global context, representing just 0.07% of the FTSE Global All Cap Index.5 That means that if a New Zealand investor were to build a portfolio that matches New Zealand’s weighting in this global index, they would have just 0.07% of their portfolio invested in New Zealand shares.

In reality, many New Zealand investors may choose to have a higher allocation to New Zealand shares. How much an investor chooses to allocate to New Zealand shares will depend on their goals, risk profile and preferences. For reference, KiwiSaver funds, on average, have 19.6% of their share portfolio invested in New Zealand shares, with the remaining 80.4% spread across Australian and global shares.6

Diversification benefit

Over recent years, global shares have outperformed New Zealand shares. However, this does not diminish the value of including New Zealand shares in a diversified share portfolio. The purpose of diversification is to combine assets that behave differently under varying economic and market conditions, thereby reducing risk. New Zealand shares can potentially enhance the diversification of a portfolio.

This is because the factors which influence New Zealand’s economy and market can be distinct from those of larger global markets, such as the US, Europe, or Asia. These differences mean the New Zealand market may not move in perfect tandem with global markets. In fact, over the past 20 years, the correlation between monthly returns from New Zealand and global shares has been just 0.53. By comparison, the Australian market is more in sync with global markets, with a correlation of 0.68.7

This lower correlation can help reduce overall portfolio volatility, as downturns in global markets may not impact New Zealand in the same way. By including New Zealand shares, investors can potentially smooth their long-term returns. It is important to note that diversification and asset allocation does not fully protect a portfolio from market risk.

Income

New Zealand shares overall currently provide a higher dividend yield than global shares. The Smart Total World ETF is trading on a gross dividend yield of 1.21% and the Smart S&P/NZX 50 ETF’s gross yield is 2.59%2. This dividend yield may appeal to income-orientated investors.

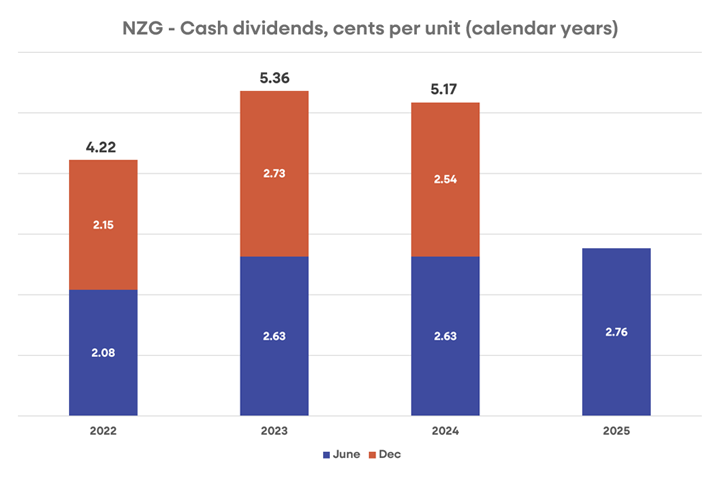

The Smart S&P/NZX 50 ETF pays distributions twice a year in June and December. Distributions are paid in New Zealand dollars and automatically reinvested for you, unless you choose to receive them in cash. Distributions paid since 2022 are shown in the chart below.

Source: Smart.

A closer look at the fund’s portfolio

Owning a slice of ‘New Zealand Inc’

With the purchase of one security, investors buying the Smart S&P/NZX 50 ETF get exposure to a portfolio of 50 of New Zealand’s leading companies. As such, this fund provides a convenient and efficient way to obtain an exposure to 'New Zealand Inc'

Top holdings

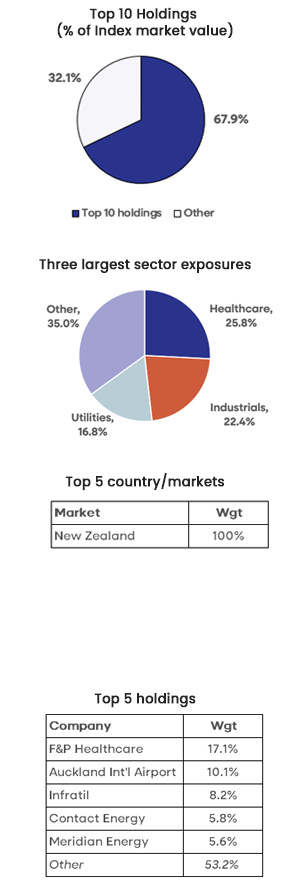

The Smart S&P/NZX 50 ETF includes a range of New Zealand’s leading companies. NZG tracks the S&P/NZX 50 Gross with Imputation Index. As such, NZG’s portfolio mirrors the companies in the index. The top 10 holdings are profiled below. These companies together represent 67.7% of the fund.

NZG - Top 10 holdings

Company | Sector | Weight (%) | Profile | |

|---|---|---|---|---|

1. | Fisher & Paykel Healthcare (FPH) | Healthcare | 17.1 | A leading designer, manufacturer and marketer of products and systems for use in acute and chronic respiratory care, surgery and the treatment of obstructive sleep apnea. Its products are sold to hospitals and healthcare facilities around the world through direct sales offices operations and a network of distributors that sell to hospitals, homecare providers and other manufacturers of medical devices. The company developed its first prototype respiratory humidifier in 1969. |

2. | Auckland International Airport (AIA) | Industrials | 10.1 | Auckland International Airport commenced operations in 1955 and has grown significantly in the intervening period. It is the major gateway to New Zealand and its revenue base comprises of airport operations (landing charges and passenger levies - approximately 48% of the total), with the balance from concession revenue, terminal charges, rents and car parking. The company was listed in 1998. |

3. | Infratil (IFT) | Financials | 8.2 | Established in 1994 as a listed infrastructure investment company, Infratil today owns renewable energy, transport, data and connectivity, and social infrastructure businesses in growth sectors. The company’s 2025 annual report states the digital sector accounts for 66% of its portfolio, with holdings in companies such as CDC (data centres) and one.nz. Renewable energy accounts for 21% of the portfolio which includes holdings in Manawa Energy and Longroad Energy. A further 8% is invested in healthcare companies, which includes Qscan and Retire Australia, and 5% in airports (Infratil has a 66% stake in Wellington Airport). |

4. | Contact Energy (CEN) | Utilities | 5.8 | Contact Energy was formed in 1996 and listed in 1999. It is one of New Zealand’s largest energy generators and retailers with over 600,000 customer connections with electricity, gas, broadband and mobile plans. Contact operates 11 power stations across New Zealand, using geothermal, hydro and thermal energy to generate electricity. |

5. | Meridian Energy (MEL) | Utilities | 5.6 | Meridian is New Zealand’s largest renewable energy generator and generates around 30% of New Zealand’s electricity. It owns and operates seven hydro power stations and six wind farms. Meridian is also one of New Zealand’s largest retailers of electricity, supplying power to more than 350,000 residential and business customers. |

6. | a2 Milk (ATM) | Consumer Staples | 5.1 | Founded in 2000, a2 Milk produces premium a2 Milk brand products around the world. Milk that is naturally rich in the A2 beta-casein protein (and free from all A1 beta-casein protein) has been found by many to be easier to digest. The company has a range of products available in Australia, New Zealand, UK, USA and China. |

7. | Mainfreight (MFT) | Industrials | 4.8 | Established in 1978 and listed on the NZX in 1996, Mainfreight is in the business of international supply chain logistics. It provides end-to-end freight services including warehousing, domestic and international distribution as well as worldwide air and ocean freight services. Mainfreight has a global network with a presence in 27 countries, 330 branches worldwide, and over 10,800 staff. |

8. | EBOS Group (EBO) | Healthcare | 4.7 | EBOS Group is the largest and most diversified Australasian marketer, wholesaler and distributor of healthcare, medical and pharmaceutical products. It is also a leading marketer and distributor of recognised animal care brands. The company has over 5,200 employees in 115 locations across Australia, New Zealand, and Southeast Asia. |

9. | Spark NZ (SPK) | Communication Services | 3.3 | Spark is New Zealand’s largest telecommunications and digital services company. Customers range from individuals, households to small businesses, government and large enterprises. Services include mobile, broadband, entertainment, cloud services and high-tech solutions such as AI and 5G. Spark (then Telecom) was formed in 1987 and was listed on the NZX in 1991. |

10. | Mercury NZ (MCY) | Utilities | 3.2 | Mercury was listed on the NZX in 2013. It generates electricity from 100% renewable sources: hydro, geothermal and wind. It is also a retailer of electricity, gas, broadband and mobile services to residential and small to medium-sized business customers. Mercury’s generation sites are located along the Waikato River (hydro), the steamfields of the northern part of the Central Plateau (geothermal) and in the Manawatu, South Taranaki, Otago and Southland regions (wind). |

Total | 67.9 |

Sources: Company websites, NZX, Smart. As at 31 May 2025.

The other companies in the fund are listed below.

Fletcher Building Chorus Summerset Group Holdings Ryman Healthcare Port of Tauranga Goodman Property Trust Precinct Properties Group Freightways Group Kiwi Property Group Gentrack Group Genesis Energy Property for Industry Air New Zealand Vector Skycity Entertainment Group Skellerup Holdings Westpac Banking Corp Argosy Property Vital Healthcare Property Trust ANZ Group Holdings | Vista Group International Channel infrastructure NZ Heartland Group Holdings Stride Property Group Fonterra Co-operative Group Vulcan Steel NNX Scales Corp Oceania Healthcare Serko Hallenstein Glasson Tower Turners Automotive Group Sanford Tourism Holdings Manawa Energy Sky Network Television Investore Property KMD brands Briscoe Group |

Source: Smart. As at 31 May 2025.

Sectors

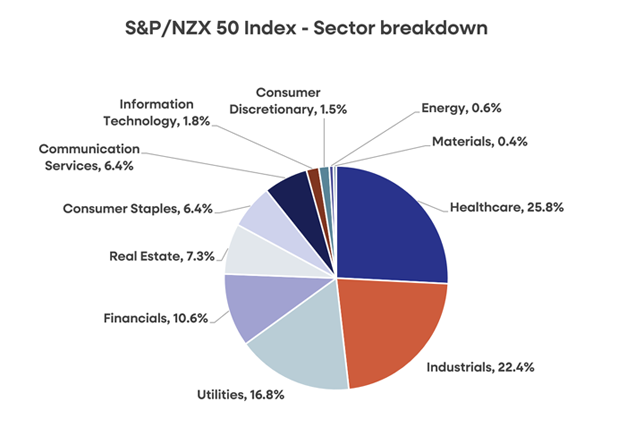

The Smart S&P/NZX 50 ETF provides exposure to a range of sectors, as shown in the chart below. With a weighting of 25.8%, healthcare is the largest sector exposure in the fund. Companies in this sector include Fisher & Paykel Healthcare and Ebos. The large electricity companies, Contact Energy, Meridian Energy and Mercury NZ underpin a 16.8% exposure to utilities. The fund also has a 7.3% exposure to real estate through its holdings in listed property vehicles such as Goodman Property Trust, Precinct Properties Group and Kiwi Property Group.

Source: S&P Dow Jones Indices. S&P/NZX 50 Index Factsheet, 30 May 2025

Combining funds to build a diversified share portfolio

A primary goal of investing is to generate the highest possible return for the lowest risk. Diversification can help obtain this balance. Spreading investments across asset classes (such as cash, fixed income and shares), countries, sectors and companies, can lower a portfolio’s risk profile as the poor performance of one investment can be offset by stronger performance in another, and vice versa. It is important to note that diversification and asset allocation does not fully protect a portfolio from market risk.

The New Zealand market is relatively small compared to global markets. To achieve greater diversification, investors may consider complementing the Smart S&P/NZX 50 ETF with other funds that provide exposure to global markets and a broader range of industries.

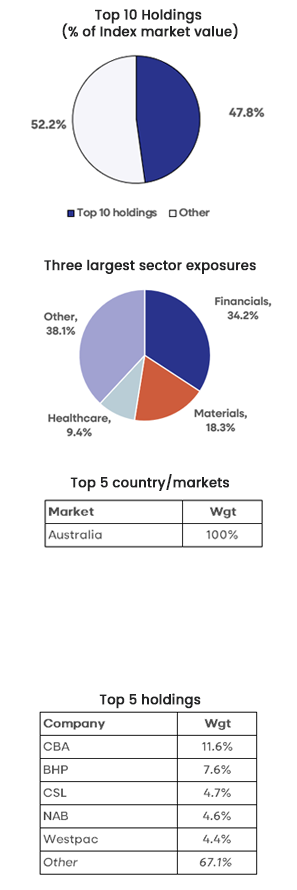

To build a diversified share portfolio, investors could consider combining the Smart S&P/NZX 50 ETF with other funds such as the Smart Australian Top 200 ETF and the Smart Total World ETF. Together, these three funds provide broad exposure to the New Zealand, Australian and global shares, offering diversification across regions, sectors and companies.

The table below outlines a selection of key details on each of these ETFs, illustrating how they can complement each other in a diversified portfolio.

Selected key details

ETF | Smart S&P/NZX 50 ETF | Smart Australian Top 200 ETF | Smart Total World ETF |

|---|---|---|---|

Ticker | NZG | AUS | TWF |

Dividend yield2 | 2.59% | 2.68% | 1.21% |

Distributions | June / December | June / December | June / December |

Annual fund charge | 0.20% | 0.30% | 0.40% |

Benchmark index | S&P/NZX 50 Gross with Imputation Index | S&P/ASX 200 Total Return Index | FTSE Global All Cap Index |

Number of stocks (companies) in the index8 | 50 | 200 | 10,015 |

Total value of stocks in the benchmark index (NZD) | $152 billion | $2,923 billion | $151,575 billion |

Smart S&P/NZX 50 ETF | Smart Australian Top 200 ETF | Smart Total World ETF |

|---|---|---|

|

|

|

This example portfolio does not take into account the investment objectives, financial situation or particular needs of any particular person. Accordingly, before making any investment decision, Smart recommends seeking professional assistance from a licensed Financial Advice Provider.

Consider the risks

All investments involve risk. Purchasing Smart ETFs does not guarantee a profit and the value of your investments can go down as well as up. The unit price of each Smart ETF can go up and down and units can trade at a discount or a premium, which means the purchase price of a unit can differ from the value of the underlying fund assets. A more comprehensive description of the risks in this type of investment can be found in the relevant Product Disclosure Statement.

Footnotes

S&P Dow Jones Indices, S&P/NZX 50 Index Factsheet, 30 May 2025.

Dividend yields are as of 30 June 2025 and sourced from Smart. Calculated by summing the prior 12-month distributions (including imputation credits) divided by the market price at the end of each business day. Past performance is not a reliable indicator of future performance.

Float-adjusted means that only the shares that are available for public trading are considered.

S&P Dow Jones Indices, S&P/NZX 50 Index announcements.

FTSE Russell. FTSE Global All Cap Index Factsheet, 31 May 2025

Morningstar KiwiSaver Survey, March 2025.

Bloomberg. Monthly returns from 31 May 2005 to 31 May 2025 for the S&P/NZX All Index, MSCI World Index and Australian All Ordinaries Index. Correlation is a measure of how two markets or securities move in relation to each other. It is measured on a range from +1.0, which means they are perfectly correlated and move in unison, to -1.0, which indicates they move in opposite directions. A correlation of zero means the two markets are not correlated.

Index data sourced from S&P Dow Jones Indices and FTSE Russell. Information as of 30 May 2025.

Disclaimer

This information is issued by Smartshares Limited (Smart), a wholly owned subsidiary of NZX Limited. Smart is the issuer and manager of the Smart Exchange Traded Funds. The product disclosure statements are available at smartinvest.co.nz.

Past performance is not a reliable guide to future performance. The calculations and returns used in this article are illustrative and intended as a guide only, and are not an indicator of future returns. The value of investments can go down as well as up and investors may not get back the full amount invested nor any particular rate of return referred to in this article. Returns are not guaranteed.

This information is intended to provide a general guide and is based upon, and derived from sources Smart considers reliable. Neither Smart nor NZX Limited, or their respective directors and employees accept any liability for any errors, omissions, negligent misstatements, or for the results of any actions taken, or not taken in reliance on this information.

This information is not a substitute for professional advice. In preparing this information Smart did not take into account the investment objectives, financial situation or particular needs of any particular person. Accordingly, before making any investment decision, Smart recommends seeking professional assistance from a licensed Financial Advice Provider.

More from Smart: